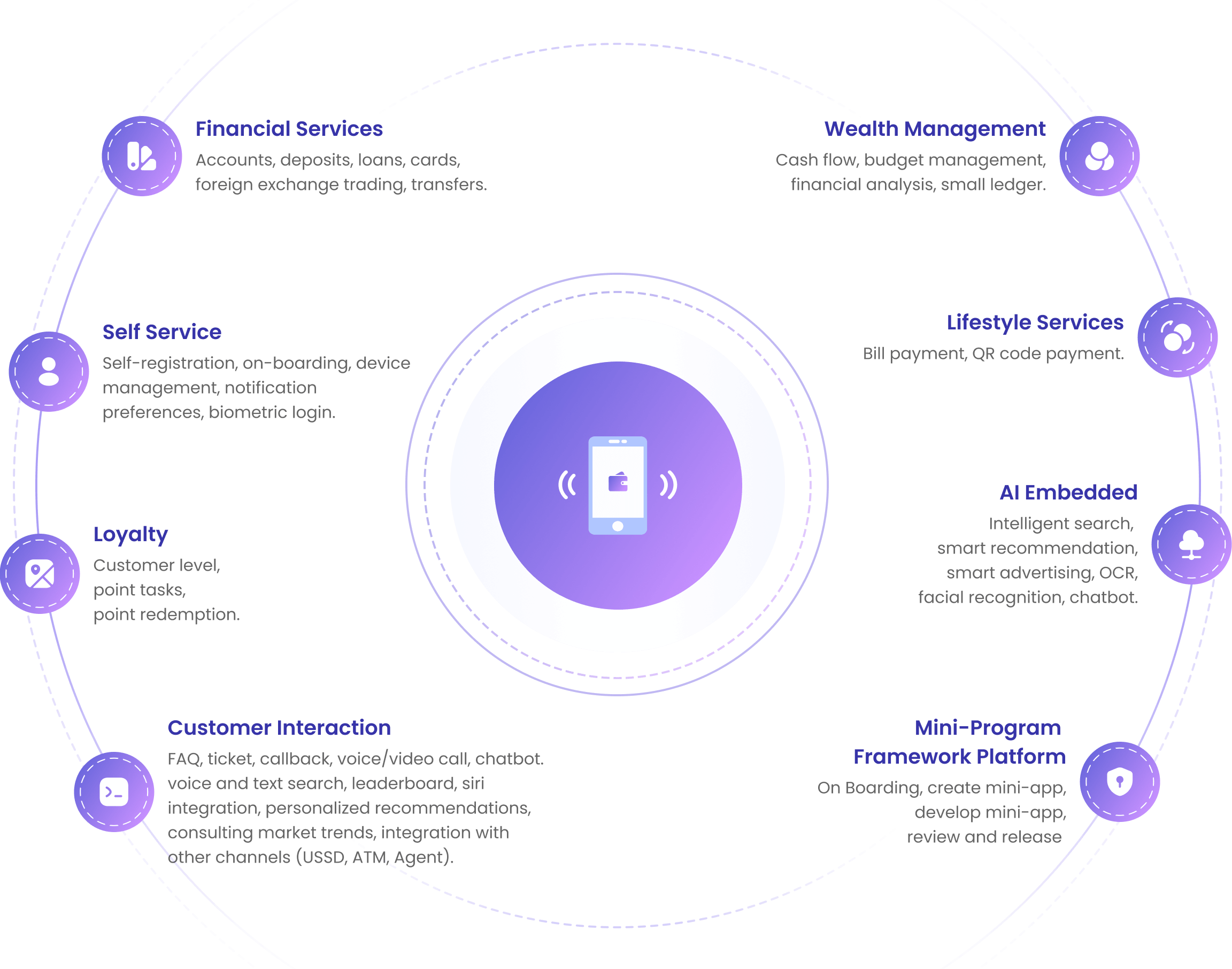

Contactless online financial services have become a trend in the digital era, and digital mobile banking system has become an important choice for the competitiveness of banks. MuRong adopts the latest digital technology and AI technology to build a mobile banking system, which has superior customer experience, comprehensive functionality, high security and stability, and flexible architecture to provide banks with the continuous innovation of financial services.

why

Choose Us?

Services

Banking

transactions.

Features

We're Here to Make Banking Better and Easier.

Easy

Access

Easy Access

Provides a user-friendly and intuitive mobile banking app that allows customers to access their accounts, make transactions, and manage their finances on the go.

Comprehensive

Functionality

Comprehensive Functionality

It not only provides retail banking products and services through apps, but also realizes digital customer service and convenience services, like lifestyle, loyalty, interaction, etc.

AI

First

AI First

Leveraging analysis of customer data, Mobile Banking uses AI technologies to provide intelligent services, like search, recommendation, advertising, chatbot, etc.

Enhanced

Security

Enhanced Security

Provides authentication capabilities for login and sensitive transactions, security mechanisms like biometrics on mobile devices effectively protect customers' assets and privacy.

Seamless

Integration

Seamless Integration

Easily integrates with third-party core banking system or card solution, and innovative services like mobile payments, social platforms, third-party financial apps.

Omni-channel

Approach

Omni-channel Approach

Provides multi-channel, multi-product, multi-scene activities to form a good interaction with customers.

Benefits

Meet All Your Financial Needs

Improve Convenience

Eliminating time and location constraints, Mobile Banking significantly enhances customers' access to banking services, and customers can conveniently manage their finances on-the-go through a user-friendly and intuitive mobile banking app.

Gain additional business

The expanded suite of financial services, from payments to investments to loans, provides banks with more touchpoints to offer and cross-sell products to customers. This can drive higher transaction volumes and revenue streams.

Strengthen Loyalty and Stickiness

Through personalized services, experience for cross-channel, robust security mechanisms, Mobile Banking strengthens the interaction and stickiness between banks and their customers.

Enhance Data Analytics and Insights

By harnessing the power of the expansive customer data, banks can significantly enhance their financial product information management strategy. This will enable them to drive more targeted marketing, offer personalized product suggestions, and make better-informed, data-driven decisions.

Expand Competitive Advantage

Incorporating advanced technologies, Mobile Banking provides secure, integrated, comprehensive, and targeted mobile banking experience can help banks differentiate themselves and expand the competition in the fast-evolving digital finance landscape.

Want To Get Started?

Get In Touch Or Download Our Brochure.